Suggestion on clause 46 a of finance bill 2017 section 115jaa extension of period of carry forward of mat credit from 10 years to 15 years clarity regarding carry forward and set off of mat credit in cases where the ten year period has expired on or before ay 2016 17 but the fifteen year period has still not expired.

Mat credit entitlement set off.

Complexity in computing the book profit under mat provisions and recent changes in accounting standards have further increased the tax compliance burden for companies.

The cag has reviewed 182 cases in 19 states and found that in some cases there was none or minimal set off that could be claimed but the a o.

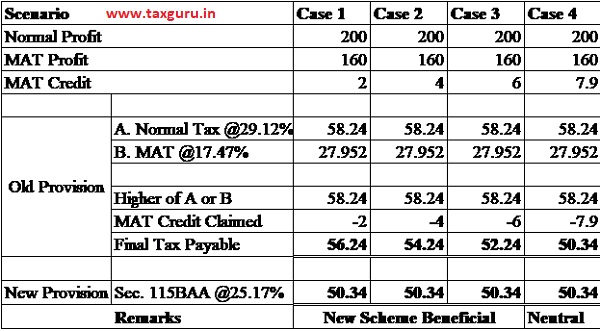

Set off shall be allowed to the extent of difference between the tax on the total income under normal provision and tax which would have been payable as per mat under section 115jb.

Moreover the mat credit set off can only be to the extent of the difference between the regular corporate tax and mat liability calculated.

Mat credit even though the carry forward period of credit has been allowed up to 15 years.

Easing the mat credit mechanism and.

The finance bill 2017 proposes to amend section 115jaa of the.

Allowed a huge amount and in some cases where set off could.

A tax credit scheme is introduced by which mat paid can be carried forward for set off against regular tax payable during the subsequent fifteen years period subject to certain conditions as under when a company pays tax under mat the tax credit earned by it shall be an amount which is the difference between the amount payable under mat and.

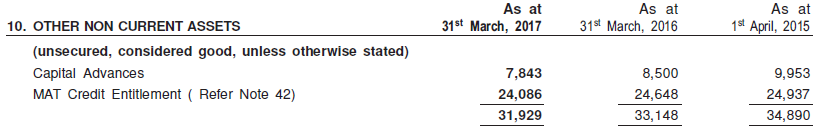

The unavailed amount of mat credit entitlement if any should continue to be presented under the head loans advances.